Perhaps you would like to fund home improvements or that dream holiday. Maybe you need cash to supplement your income, pay off debts or to help your children onto the property ladder. Equity Release can be the route to all of these financial goals, as it unlocks the money currently tied up in your property. We would be happy to discuss your situation in confidence, and without charge or obligation of any kind.

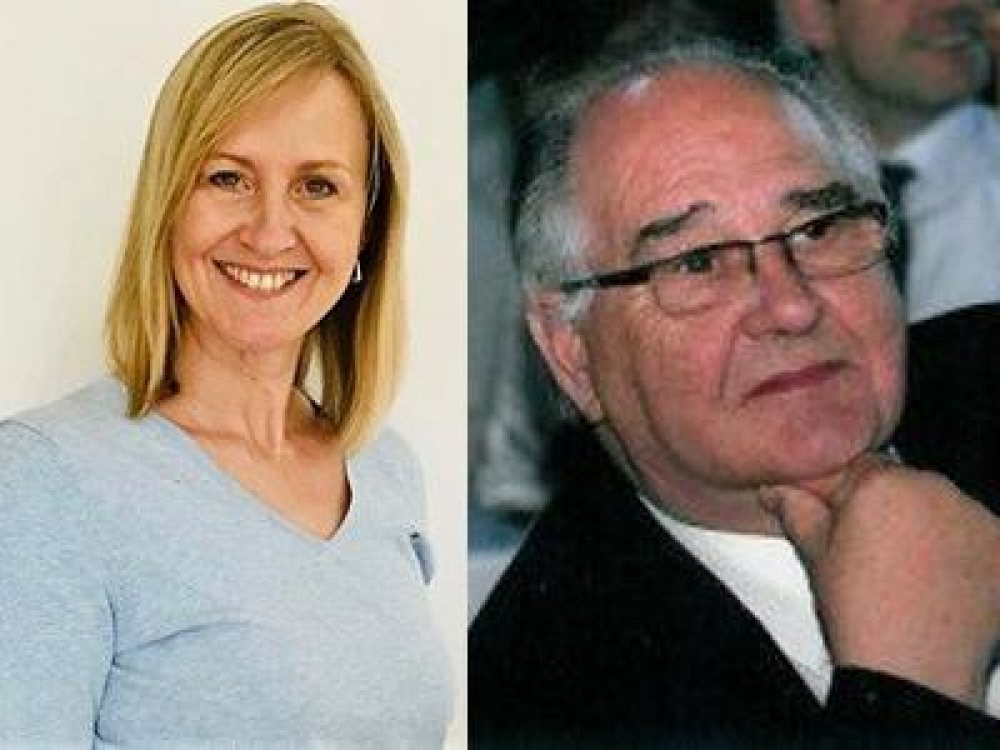

Tracy Ellis-Fuller and Norman Rushbrook work with The Equity Release Experts who provide whole of market advice.

A few typical uses are listed but remember the money is yours to use as you choose.

It can enable people to pay off existing interest only mortgages coming to an end or clearing other debts which may have become a worry.

For others a way of helping family or funding things they have wanted to do and thought unable to do so.

Options for life, Equity Release Options and Options Financial Planning are trading styles of Norman A Rushbrook Cert.PFS CeMAP. CeLTM. CeRER and Tracy Ellis-Fuller CeMAP. CeRER.

Norman A Rushbrook Cert.PFS CeMAP. CeLTM. CeRER and Tracy Ellis-Fuller CeMAP. CeRER are Equity Release Specialists. Options For Life are introducers only to The Right Equity Release Ltd. The Right Equity Release Ltd. are regulated by the Financial Conduct Authority.

Click on the question to reveal the answer.

There are two main types of Equity Release These have different final outcomes and therefore suit very different clients.

The most popular type of Equity Release. A loan secured against your home whilst still allowing you to retain 100% ownership of the property. Available to those aged over 55 with a property value exceeding £70,000

This involves selling part or all of your property to a home reversion provider whilst retaining the right of occupation, however you will no longer be the legal owner. These plans are available to people aged over 65.

If you chose a Drawdown Lifetime mortgage you could draw some of your equity now and keep the rest in an interest free reserve and only draw on it as and when you need it. Interest would not be added until you access further funds, saving you money on the overall cost of your plan.

An initial minimum loan of £2500 + A fixed term monthly income of an amount agreed at the outset, paid automatically in to your account for a chosen term.

Interest rollup - no monthly repayment - Allows for the accumulated interest to be added throughout the term and repaid upon death or entry in to long term care. Interest payments - Monthly payment by direct debit of all or part of the interest from the outset, can revert to roll up in the future. Ad Hoc capital payments - Ability to make payments up to an agreed percentage of the capital borrowed in any 12 month period.

Many other product options are available to suit individual needs. Please call to discuss.

As independent equity release specialists, we can recommend plans from the whole market to suit your circumstances, we will ensure you consider alternatives, explain the advantages and disadvantages of Equity Release and on some occasions we may advise that this is not the best option for your needs.

This initial consultation will be free of charge. If you decide to go ahead with an Equity Release plan, there may be some initial charges, possibly a survey fee, on completion there will also be a solicitors fee and our advice fee. These will be fully explained to you before you decide to proceed.

Equity release is regulated by the Financial Conduct Authority (FCA). This is the UK's financial regulatory body whose aim is to ensure protection for consumers, enhance market integrity and promote effective competition.

In addition, the Equity Release Council (ERC), an industry body for the UK equity release sector, provides extra safeguards. Plans meeting their standards ensure:

All members of the ERC must adhere to the Council's Statement of Principles, designed to promote high standards of conduct and practice.

Equity release will reduce the value of your estate and may also affect your entitlement to means-tested benefits. You should always think carefully before securing a loan against your home.

Unless you decide to go ahead our service is completely free of charge, as our fixed advice fee of £1,499 is only payable on completion of a plan.

A lifetime mortgage is the most popular form of equity release, and is a loan secured against your home that's typically repaid when you pass away or go into long-term care.

Norman Rushbrook Cert.PFS CeMAP CeLTM CeRER and Tracy Ellis-Fuller CeMAP CeRER are Equity Release Specialists registered with the Equity Release Council and are advisers working on behalf of The Equity Release Experts. Financial Services Register number: 224987. You can check this on the Financial Services Register by visiting the FCA's website www.fca.org.uk/register.

The Equity Release Experts, is a trading name of TERE Advisers Ltd which is an appointed representative of Key Retirement Solutions Ltd, which is authorised and regulated by the Financial Conduct Authority, Registered in England No, 12269172. Registered Office: Baines House, 4 Midgery Court, Fulwood, Preston, PR2 9ZH, United Kingdom. Telephone: 0345 165 5955.

The advice and / or guidance contained within this website is subject to the UK regulatory regime and is therefore targeted at consumers based in the UK.