Thinking about your Will and how you would like your Estate to pass on death can be an uncomfortable thing to do, however it is a thoughtful and responsible way to spare your family the emotional and financial burden of organising your Estate at the time they can least cope.

Professional Estate Planning will protect your assets and grant you the peace of mind knowing that you have safeguarded the future of your loved ones. Talk to us and we can organise it all for you.

Whilst writing a Will is better than no planning at all, in our experience the majority of clients would benefit from Estate Planning to deal with concerns such as:

A Lasting Power of Attorney (LPA) can only be made while you have mental capacity, without which it would be necessary for your family to apply to the court of protection in order to become your "deputy" and make decisions on your behalf.

This is an extremely costly and time consuming procedure and the powers granted are limited when compared with those of an appointed Attorney.

A Financial LPA allows your appointed attorney to handle your financial affairs on your behalf should it become necessary.

Making an LPA for health & welfare allows your chosen Attorney to make important decisions in your best interest including giving or refusing certain types of medical care and the choice of your care home.

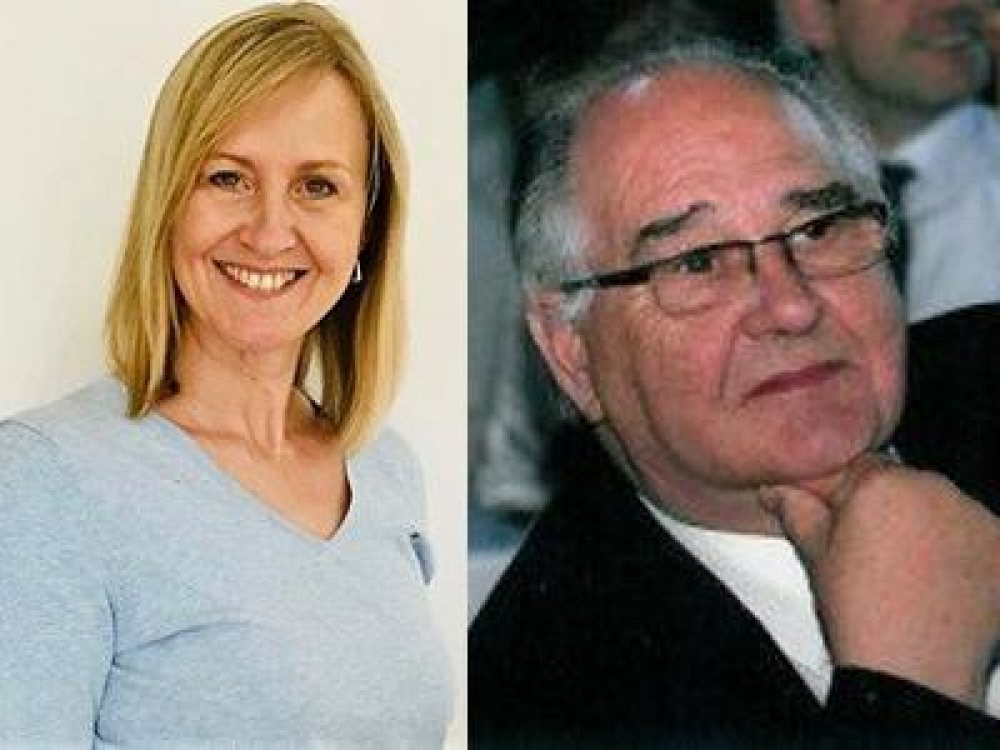

Options for life, Equity Release Options and Options Financial Planning are trading styles of Norman A Rushbrook Cert.PFS CeMAP. CeLTM. CeRER and Tracy Ellis-Fuller CeMAP. CeRER.

Norman A Rushbrook Cert.PFS CeMAP. CeLTM. CeRER and Tracy Ellis-Fuller CeMAP. CeRER are Equity Release Specialists. Options For Life are introducers only to The Right Equity Release Ltd. The Right Equity Release Ltd. are regulated by the Financial Conduct Authority.

Click on the question to reveal the answer.

"Put your mind at rest while you're alive and protect your assets for your family when you're gone."

Equity release will reduce the value of your estate and may also affect your entitlement to means-tested benefits. You should always think carefully before securing a loan against your home.

Unless you decide to go ahead our service is completely free of charge, as our fixed advice fee of £1,499 is only payable on completion of a plan.

A lifetime mortgage is the most popular form of equity release, and is a loan secured against your home that's typically repaid when you pass away or go into long-term care.

Norman Rushbrook Cert.PFS CeMAP CeLTM CeRER and Tracy Ellis-Fuller CeMAP CeRER are Equity Release Specialists registered with the Equity Release Council and are advisers working on behalf of The Equity Release Experts. Financial Services Register number: 224987. You can check this on the Financial Services Register by visiting the FCA's website www.fca.org.uk/register.

The Equity Release Experts, is a trading name of TERE Advisers Ltd which is an appointed representative of Key Retirement Solutions Ltd, which is authorised and regulated by the Financial Conduct Authority, Registered in England No, 12269172. Registered Office: Baines House, 4 Midgery Court, Fulwood, Preston, PR2 9ZH, United Kingdom. Telephone: 0345 165 5955.

The advice and / or guidance contained within this website is subject to the UK regulatory regime and is therefore targeted at consumers based in the UK.